wealth

As the Apostle Paul warns us in 1 Timothy 6:9: “But those who want to be rich fall into temptation and are trapped by many senseless and harmful desires that plunge people into ruin and destruction.” And if you want proof of Paul’s words, look no further than the release of Jeffrey Epstein’s emails.

In his book PreachersNSneakers: Authenticity in an Age of For-Profit Faith and (Wannabe) Celebrities, published last month, Ben Kirby does more than throw stones at ultra-wealthy pastors; he asks readers to self-audit and consider where they’re spending, lest they throw that stone and shatter their glass houses.

Wealth advisers teach us why and where to stockpile our assets and how to diminish our liabilities. “Save! Save! Save! Put away for rainy days. Establish your kid’s college nest egg now! Buy low and sell high! Get real estate to get more bang for your buck! Don’t touch your 401(k) or you’ll risk having nothing for retirement!” And of course, they earnestly urge, “Set aside enough for taxes or be bitten by Uncle Sam in the end!” Any good wealth adviser aims to cure their clients of unsound “robbing Peter to pay Paul” financial practices. Managing portfolios calls for vigilance because markets can be highly volatile and thus vulnerable to external forces beyond one’s control. For this reason, sound investment strategy requires advanced planning, goal-setting, and staying focused. This month’s gospel readings address the importance of honoring one’s faith journey by carefully calculating costs and practicing disciplined stewardship.

These themes color the pages of Luke’s gospel but also inform Paul’s eldering counsel to his young devotee, Timothy. Paul writes: “There is great gain in godliness combined with contentment” (1 Timothy 6:6), for true satisfaction is discovered at the site of contentedness, not on “the uncertainty of riches” (verse 17).

Our spiritual ledgers get out of whack when wealth accrual is decoupled from gratitude and when we forsake practical wisdom. Dialing back the spiritual appetite for hoarding temporal goods is not only good stewardship but crucial for securing tomorrow’s sacred dividends. Having an appropriate perspective on wealth is the initial deposit for moving into the life-giving presence of a debt-canceling God.

September 1

Forsaking Fidelity

Jeremiah 2:4-13; Psalm 81:1, 10-16; Hebrews 13:1-8, 15-16; Luke 14:1, 7-14

Biblical storylines of God’s dealings with Israel vary little in terms of plot. The master narrative of unrequited love loops over and again in the prophetic literature. Taglines proceed in this order: “As they pursued worthless things, they forgot their first love and were forced to submit to the exacting demands of their foreign foes. Yet again, a faithful God is love-spurned by a prized people who contented themselves with serving lesser gods of their own making.” Sacred love tales of this sort get nauseating, at least I think so.

My wife and I are beginning to start the process of buying a house for the first time. For better or for worse, we have become regular viewers of HGTV’s line of television shows that target would-be home consumers just like us. There’s Fixer Upper, Flip or Flop, Property Brothers, Love It or List It, and…boy, could I go on. On the one hand these shows give us an interesting entree into what’s possible when it comes to buying and renovating a house. They may expand our vision so we don’t get stuck on things like existing wallpaper, old carpet, or hideous paint color. But, as I’ve come to understand the (very predictable) arc of these shows, I’m also struck by their danger. They’re basically “Keeping Up with the Joneses” on steroids.

Australian artist Toby Morris’ comic “On a Plate” illustrates how privilege works — and why people who benefit from it can’t see it.

By following two individuals’ life paths set side-by-side, Morris shows how someone’s privilege — or lack thereof — can lead to totally different outcomes.

THE DEMOCRATIC REPUBLIC of Congo is one of the world’s poorest countries. In 2014, Congo ranked 186 out of 187 on the United Nations’ human development index—vying with Niger for the bottom of the list.

Yet Congo is extremely rich in soil, water, forests, and minerals. Diamonds, copper, gold, oil, uranium, and coltan are all mined, purchased, and traded from the DRC.

Coltan is the ore used in electronic devices. The so call “war of coltan” in the mineral-rich eastern Congo has left millions dead and more than a million women raped. Transnational corporations are able to exert extreme pressure on Congo’s weak government and economy. As a result, the country’s natural resources have become an important factor in increasing poverty and violence rather than wealth and development.

The Catholic bishops in Congo (about half of the country’s population is Catholic) repeatedly have denounced three specific kinds of evil: a climate favoring genocide, outbreaks of religious fundamentalism, and a push toward Balkanization.

Sébastien Muyengo, author of In the Land of Gold and Blood, is the Catholic bishop of Uvira in eastern Congo. As a result of the mineral wars, he writes, the country’s poverty has become a mental, human, and structural poverty, rather than predominantly material. Yet Congo has resources the rest of the world wants.

Right-wing Christians and the politicians who pander to them like to say that the United States was, is and always should be a “Christian nation.”

Why, then, are they so obsessed about money and political power and so determined to make people afraid?

After all, Jesus spent an estimated two-thirds of his teaching time on wealth and power. His message was clear, if radical: Give wealth away rather than build bigger barns. Submit to others rather than seek power. Love your enemies rather than smite them.

Moreover, his one new commandment was equally clear: Don’t be afraid. Live without fear. Live in trust and confidence. Live in harmony. Make peace. But whatever happens, don’t be afraid.

Instead of preaching a gospel of self-sacrifice and generosity, right-wing Christians support the mega-wealthy who yearn to stifle democracy and move us further toward plutocracy: Keep the riffraff from voting. Keep alternative views out. Live in the bubble of like-minded people, not the marketplace of ideas and diversity where Jesus lived.

While there are no biblical texts speaking directly to the issue of money in politics, biblical principles are still relevant, and people of faith have an important role to play in the emerging debate about the future of our democracy. Before exploring those principles, however, it is important to understand the serious issues of inequality currently present in our system, and the correlation between inequality and the money flooding our political system.

The richest 1 percent own more of the nation’s wealth than the bottom 90 percent. The richest one-tenth of one percent have as much pre-tax income as the bottom 120 million Americans.

In Affluence and Influence, political scientist Martin Gilens concludes that, “The preferences of the vast majority of Americans appear to have essentially no impact on which politics the government does or does not adapt.” He details the data throughout his book that clearly demonstrates policy makers are only listening to the wealthy donor class. This situation has been made even worse by the Supreme Court’sCitizens United in 2010, which allowed a huge influx of money to flood our political system after declaring the personhood of corporations.

The Court’s more recent decision in McCutcheon v FEC made matters even worse. Before McCutcheon, one person was able to contribute up to $123,000 to political candidates and parties. In striking down this aggregate limit, the Court paved the way for individuals to contribute more than $3.5 million directly to candidates and party committees. In a report detailing the potential impact of McCutcheon, Demos predicts the decision could result in more than $1 billion in additional campaign contributions by 2020.

In a marketplace unfettered by ethical restraint, a sense of duty, concern for others, or even basic shame, 25 hedge fund managers gave themselves a 50 percent pay boost in 2013.

Never mind that hedge funds’ performance, on average, tanked for the fifth consecutive year.

These 25 men wanted big bucks, so they took them: a total of $21 billion. All for managing wealth that someone else created and, except for a few, not managing it particularly well.

The top earner paid himself $3.5 billion for 2013.

ON NOV. 5, 2013, the people of SeaTac, Wash., enacted the highest minimum wage in the country, $15 an hour, more than double the federal minimum wage of $7.25 an hour.

On Black Friday, the biggest shopping day of the year, Wal-Mart workers at more than 1,500 store locations conducted protests and informational pickets. Fast-food workers in more than 100 cities protested in front of McDonalds, KFC, and Taco Bell stores, calling for wage increases.

Across the U.S., a grassroots movement is blossoming to address the extreme inequality of wealth and wages. Led by low-wage workers and bolstered by faith community leaders, this movement is shining a spotlight on the glaring disparity of wages, wealth, and opportunity.

The wealthiest 1 percent of households, those with annual incomes over $555,000, now receives more than 21 percent of all income. Meanwhile, millions of low-wage workers subsist on the federal minimum wage, which is $15,080 a year for a full-time worker. As a result, many low-wage workers depend on charity and public subsidies such as food stamps and Medicaid to survive.

If the minimum wage had kept up with inflation since 1968, it would now be $10.74, enough to boost a family of three over the federal poverty line, according to the Economic Policy Institute. If the minimum wage had increased at the pace of worker productivity, it would be $18.72 an hour today.

Jesus was quite clear that our allegiance was to be with the POOR, not the barons of Wall Street.

God's laws are immutable Gravity. Aging. Those sorts of things. We cannot change them. But we DO know that mere humans MADE UP the laws of the market economy and we don't have to follow its rules. We can choose to, but it’s a choice.

The rules that run our capitalistic system were invented by us. And we really do not have to play by those rules.

A recent report by OXFAM offered some sobering data about both the concentration and flow of wealth in the world today. A few key points, also summarized by a new business article on The Atlantic website , include:

- The richest 85 people in the world control as much wealth as the poorest 3,000,000,000 people;

- Nineteen out of 20 “G20” countries are experiencing growing income inequality between rich and poor;

- In the United States in particular, 95 percent of the post-financial-crisis capital growth has been amassed by the richest 1 percent of Americans;

- While domestic income inequality continues to grow, the income tax rates for wealthiest Americans have steadily dropped.

My first reaction to seemingly immoral concentrations of wealth, and the systems that enable it, is anger and a compulsion to call them out, to change them and to distribute the world’s treasures evenly among all of God’s people.

But what if we need the insanely wealthy to realize a kingdom-inspired vision for our world?

JEREMIAH IS OUR uncomfortable and discomfiting companion this month. He is a vehemently emotional man of God. Far from struggling to bring his emotion under control, he instead prays for more raw grief and anger. He knows that even his current rage and tears in no way match the scale of devastation wreaked by unfaithfulness to God’s covenant. “For the hurt of my poor people I am hurt, I mourn, and dismay has taken hold of me. Is there no balm in Gilead? Is there no physician there? Why then has the health of my poor people not been restored? O that my head were a spring of water, and my eyes a fountain of tears, so that I might weep day and night for the slain of my poor people!” (8:21 - 9:1). To be a prophet is to risk letting our hearts resonate with the feelings of God. Jeremiah might help us discern whether our own witness for justice has turned into something too rational, measured, even routine. How do we re-engage our hearts and derive our passion from God’s divine passion?

Luke’s deep concern to show Jesus’ prophesying against the toxicity of Mammon, the power games of the wealthy, is ablaze in the gospel readings. Perhaps those who read them to us in church should preface them with a warning along the lines of Bette Davis’ famous quip in All About Eve: “Fasten your seatbelts. It’s going to be a bumpy night!”

The Great Gatsby doesn’t exactly fit the mold for a story about poverty. It doesn’t play into the typical genre created by Dickens or Sinclair meant to incite social change by depicting feeble orphans or working-class suffering. Gatsby is a story of excess: of tall buildings, big parties, fancy clothes, shiny cars—all that 1920s glam and glitz.

And yet — distilled to its core, The Great Gatsby is a story of poorness from the lens of richness, a rags-to-riches story where we only get to see the riches. Though high school English classes across the country paint Jay Gatsby as the poster child for the American dream and its subsequent loss, The Great Gatsby gets its poignancy not from what is lost but rather what lingers — Gatsby’s offstage childhood poverty that not even money can erase. For underneath Jay Gatsby’s million-dollar façade is James Gatz, a college-dropout, janitor-turned-swindler “young roughneck” from a poor family.

This week's viral video is a must-see. The six-minute "Wealth Inequality in America," released Friday, presents the shocking, true size of the wealth gap in the country.

In a series of animated infographics, the video lends a visual punch to numbers that are hard to wrap one’s head around. The top 1 percent of Americans hold 50 percent of all investments in stocks and bonds, for example – while 80 percent of Americans share a paltry 7 percent of the nation’s wealth.

Ask a random group of people, “How do we improve our public schools?” and you’re apt to get divergent, passionate answers. Christians, like other citizens, have different opinions on how to heal what’s hurting in our education system. What we can share is a belief that all children are truly precious in God’s sight and an understanding that public education is a key component of the common good—that a healthy school system has the potential to bring opportunity and uplift to children regardless of their economic status.

Jan Resseger is the minister for public education and witness with the national Justice and Witness Ministries of the United Church of Christ. She spoke with Sojourners associate editor Julie Polter in June.

Sojourners: Why is public education a commitment for the United Church of Christ?

Jan Resseger: The commitment to education is a long tradition for us. Our pilgrim forebears brought community schooling and higher education to the New England colonies—New England congregationalism is one of our denominational roots. Another root is the American Missionary Association (AMA), an abolitionist society that grew out of the defense committee for the Africans on the slave ship Amistad. The AMA founded schools for freed slaves as a path to citizenship across the South during and after the Civil War.

Several denominations came together as the UCC in 1957, and our general synods since then have taken stands on issues such as the protection of the First Amendment in public schools and supporting school desegregation through the ’60s, ’70s, and ’80s. From 1958 to the present, we have spoken to institutional and structural racism and classism in schools. We also have addressed privatization, because we’ve been strong supporters for many, many years of public schools as key to the strength of our society and democracy.

Jonathan Kozol, author of Fire in the Ashes, talks about the gripping stories of poor children, the problems of “obsessive testing,” and how to build a school system worthy of a real democracy. An interview by Elaina Ramsey.

HISTORICALLY, MOST ECONOMIC systems revolve around who owns the wealth. As an economist and historian, this is the question I bring to any discussion about our current economic crisis and any future “new economy” we might imagine.

While income distribution is important, wealth distribution is much more unevenly allocated in American society, and it gets very little attention. Let’s quickly look at the numbers.

The richest 400 people in the U.S. own more wealth than the bottom 60 percent of the population. That’s more wealth (stocks, bonds, and businesses, but also houses and cars) than the bottom 150 million Americans. And the top 1 percent owns almost 50 percent of the society’s productive investment assets (corporate stocks, bonds, and privately held businesses, excluding cars and houses).

When you ask who owns the productive assets of the society, then you’re asking who owns American capitalism. The answer is: The top 1 percent owns just under half of it.

With this kind of wealth distribution, what we have is literally a medieval structure. I don’t mean that figuratively. It is a feudalistic structure of extreme power and wealth. And it is anathema to democracy to have that kind of concentration. This distribution of wealth—and the the fact that the top 1 percent has, over the last 30 years, increased its share of income from about 9 percent to about 20 percent—tells you something about the political/economic power harnessed to achieve that end.

The “new economy movement” that is building momentum around the country asserts that you can’t have a democratic society unless you democratize the ownership of wealth as well.

Scrooge calls Christmas a “humbug.”

When his nephew tries to convince him otherwise, Scrooge responds:

“Merry Christmas! What right have you to be merry? What reason have you to be merry? You’re poor enough.”

The nephew retorts:

“What right have you to be dismal? What reason have you to be morose? You’re rich enough.”

The nephew concludes with this famous line about the holiday:

“Therefore, uncle, though it has never put a scrap of gold or silver in my pocket, I believe that it has done me good, and will do me good; and I say God bless it!”

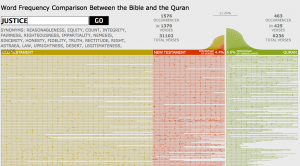

This morning, as I caught up on what had been going on in the world over the weekend, I stumbled across a very interesting resource -- a website that compares the frequency with which words appear in the Bible and the Quran.

Although that in itself is an interesting tool, I was less interested in the comparison feature and more interested to see how often certain words appear in the Bible.