Economic

Mary, the mother of Jesus, sings at Christmas. It's not your typical carol. Hers is a song of thanks and praise, but Mary's sweet soprano voice is deceiving.

Her canticle, The Magnficat, is recorded in the Gospel According to Luke. The text is assigned to be read in the churches Sunday.

Mary sings about politics and economics, the dangers of unchecked power and the foolishness of false pride, and what it means for persons and nations to eschew the common good.

Mary sings of the outstretched arm of a Holy God who is effecting a great reversal in the world: the proud are scattered, the mighty brought low, the lowly raised up, the rich sent away empty and the hungry filled.

Mary sings the world forward, toward a global community of justice and compassion.

A first thought? How uncharacteristic of an expectant mother, this song! A second thought? Perhaps not so unusual.

The global movement to implement a small tax on some financial industry trades has gained its first European partner: France. Religious and economic reform groups have been leading the movement to implement versions of what has been called the "Robin Hood Tax" or the "Tobin Tax" since the 1990s. As global markets falter and national economies are brought to their knees by an unregulated financial industry, this financial transaction tax is one small way to impact global reform.

The global movement to implement a small tax on some financial industry trades has gained its first European partner: France. Religious and economic reform groups have been leading the movement to implement versions of what has been called the "Robin Hood Tax" or the "Tobin Tax" since the 1990s. As global markets falter and national economies are brought to their knees by an unregulated financial industry, this financial transaction tax is one small way to impact global reform.

>>On 1 August, France became the first European country to introduce a new financial-transaction tax (FTT) on equity sales and high-frequency trading.

The FTT, often called a ‘Robin Hood tax', is a tax on selected products traded by the financial sector, such as equities, bonds, foreign exchange and their derivatives. Where those countries where such a tax has been introduced (in South Korea, South Africa, India, Hong Kong, the UK and Brazil), the tax may have been tiny (ranging between 0.005% and 0.5%), but it has raised substantial amounts of revenue. The FTT discourages high-risk financial operations and makes the financial sector pay its fair share of taxes. This is sensible: a reckless casino culture in parts of the financial sector caused the financial crisis. It is also fair: our governments bailed out the banks but left taxpayers with debts of trillions.<<

Read more here.

Less than one percent of the federal budget goes to foreign aid. Our spending on development and foreign assistance is not -- by any stretch of the facts or imagination -- our national debt.

Cutting foreign aid programs will do little to get us out of debt, but would be a devastating setback in the fight against global, extreme poverty.

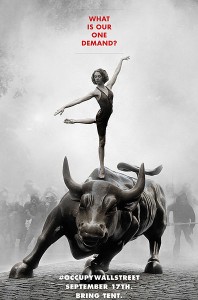

Occupy Wall Sreet, false idols and a moral economy. Breaking the cycle of poverty. Poorest poor in U.S. hits a new record: 1 in 15 people. As poverty deepens, giving to the poor declines. Arianna Huffington: Shakespeare, the Bible and America's shift into a punitive society. Peaceful Occupy Oakland march followed by late-night clashes.

Abuse at Afghan Prisons. How Catholic Conservatives could turn the GOP presidential race. OpEd: Jesus would not #OccupyWallStreet. OWS is "largely secular." Religious leaders see immigration as "God's Call." OpEd: Alabama new immigration law has unintended consequences. OpEd: Wall Street Worship. Could 2012 be the most ideological election in years? And much more.

We're in this thing together or we're not in this thing at all.

We're in this thing together or we're not in this thing at all.

We should all be marching in the streets.

We are the 100 percent.

We are poor. We are well-to-do. We are those somewhere in the middle. We are aware of the struggles and unfairness of this world and for this reason we are sensitive to one another's needs. So, we love our neighbors as ourselves.

Finally, as President Obama has announced, this American war will soon be over, with most of the 44,000 American troops still in Iraq coming home in time to be with their families for Christmas.

The initial feelings that rushed over me after hearing the White House announcement were of deep relief. But then they turned to deep sadness over the terrible cost of a war that was, from the beginning, wrong; intellectually, politically, strategically and, above all, morally wrong.

The War in Iraq was fundamentally a war of choice, and it was the wrong choice.

As I read the blogs and watch the news about what's happening in New York and around the country, I can't help but wonder: If Jesus were walking the streets of New York today, would he be a rabble-rouser activist like he was at the temple, or would he walk up to the CEO of Goldman Sachs and give him a hug?

Occupy Wall Street's struggle for nonviolence. What do marriage and family have to do with economic growth? Map: Protesters' long-term plans for occupying Zuccotti Park. Herman Cain to meet with Arizona sheriff Joe Arpaio over immigration. While corporate profits are at 60-year high, main street businesses continue to struggle.

The atlas also documents other dramatic trends, including the fragmentation of Christianity. New denominations, often borne out of strife and division, multiply endlessly. In Korea, for instance, there are now 69 different Presbyterian denominations. At the rate we are going, by 2025 there will be 55,000 separate denominations in the world!

That is an utter mess fueled by rivalry and confusion that hampers the church's witness and makes a mockery of God's call to live as parts of one body.

The atlas also documents the dramatic rise of revival movements throughout the world, and charts the story of Pentecostalism's rise. From its beginning a century ago, Pentecostalism now comprises a quarter of all Christians in the world. This fundamental change in Christianity's global composition, along with its geographical transformation, has created a dramatically different Christian footprint in the world.

The new movement called Occupy Wall Street now has spread across the country, from the very seats of our political and financial power and our largest cities, to suburbs and small towns. In some communities small groups of a few dozen have formed and in some cities thousands have gathered.

In each instance, no matter the size, people's frustrations, hurt and feelings of being betrayed by our nation's politicians and economic leaders are clear and they want to be heard.

We will likely see images and hear things that will offend us and some that will inspire.

We'll hear demands that we agree with and some that we don't.

And that's OK.

#OccupyWallStreet (the New York-based protest against social and economic inequality, corporate greed, and the influence of corporate money and lobbyists on government) has moved to a new location, a street where the air is far sweeter than on Wall Street.

#OccupyWallStreet (the New York-based protest against social and economic inequality, corporate greed, and the influence of corporate money and lobbyists on government) has moved to a new location, a street where the air is far sweeter than on Wall Street.

Won't you tell me how to get, how to get ... there?

That's right, folks, the occupation has taken over Sesame Street.

Just a few days after I returned from my respite in the mountains, Israeli forces killed eight Turkish nationals and one American on a Gaza-bound aid flotilla. Protests erupted all over Israel and Palestine.

Just a few days after I returned from my respite in the mountains, Israeli forces killed eight Turkish nationals and one American on a Gaza-bound aid flotilla. Protests erupted all over Israel and Palestine.

In the midst of this tragic chaos I found myself visiting my yoga center more often than usual, hoping to find another glimpse of the peace I had tasted so vividly just a few days before. Perhaps these wise, centered people could offer a perspective that would look forward to a vision of understanding, or reconciliation -- a vision too often missed by politicians, military officials, media, and even activists.

From the official statement by #OccupyWallStreet: "As one people, united, we acknowledge the reality: that the future of the human race requires the cooperation of its members; that our system must protect our rights, and upon corruption of that system, it is up to the individuals to protect their own rights, and those of their neighbors; that a democratic government derives its just power from the people, but corporations do not seek consent to extract wealth from the people and the Earth; and that no true democracy is attainable when the process is determined by economic power."

My daughter attended her first day of kindergarten today. A poignant milestone dressed up in an exceptionally cute plaid jumper.

My wife and I thought we were pretty cool with it. Our daughter had attended preschool, after all, so this wasn't a major logistical change. She was excited as we dropped her off, said goodbye with a smile over her shoulder, then back to drawing in her new notebook.

We still thought we were cool with it after we signed up for PTA at the courtyard table. We ran into the local rabbi. My wife is pastor at a Lutheran church in town and they cross paths regularly. The rabbi's third child was starting kindergarten. He's an old hand at this.