job creation

People of faith and immigration activists around the country have their eyes fixed on Congress this month as both houses take up immigration reform. The bipartisan proposal being considered in the Senate would bring hope and opportunity to 11 million new Americans who aspire to be citizens, doing much to fix our broken immigration system.

While the path forward will be difficult, there is some good news this week that will influence the way policymakers think about this issue.

Conservative lawmakers have long been worried about the future costs of immigration reform, which they predicted would come from federal programs designed to help the poor such as Medicaid. They asked the Congressional Budget Office – a non-partisan government agency tasked with evaluating the cost of all legislative proposals – to give them a report far into the future to make sure that these costs were not hidden in their analysis.

In reality, the CBO found that bipartisan immigration reform in the Senate would trim nearly $1 trillion off the federal deficit, while spurring the economy and creating jobs.

Rare red pandas, wrestling in the snow. Image via Wiki Commons http://bit.ly/xcpR67

Having critics isn’t a bad thing. Sometimes they serve as a sort of public accountability. Other times, they express questions that others might be asking but haven’t voiced.

Marvin Olasky, editor in chief of World Magazine, came out with a quick critique of Sojourners’ press release celebrating the Obama Administration’s decision to reject the current plans for building the Keystone XL pipeline. His post offers an excellent opportunity to address a few things that others might have been wondering as well.

His headline? “Sojourners and Keystone: Using the Bible for Political Purposes.”

Social Muddle: Business, Justice, and the Gospel are Already Social; Obama Refers to His Christian Faith During National Tree Lighting Ceremony; Fount of Blessing, Fount of Youth: Age and the American Church; One-Third of Shelter Residents Are Newly Homeless; U.S. Unemployment Rate Falls to Lowest Level in Nearly Three Years; Gingrich Says Poor Children Have No Work Habits; For Afghan Woman, Justice Runs Into Unforgiving Wall of Custom.

Private Sector Adds 206,000 Jobs In November; Police Clear Occupy Camps In Los Angeles, Philly; Churches Help Occupy Movement Survive Crackdowns, Winter; Study: Even With More Kids In Poverty, Number Of Uninsured Children Fell 14 Percent Over 3 Years; Poverty Soars For Students In D.C., Montgomery County; Anonymous Iowa Christian Group Launches Attack On Gingrich; Should Fair Trade Certify Giants Like Nestle and Folger's?; Long Lines For Free Holiday Food Vouchers.

With the opening of the G20 Summit in Cannes, France today, an idea that's been around for awhile is in the news again and gaining more attention as a result of the #OWS movement: The so-called "Robin Hood tax," a minimal tax on all financial transactions with the resulting revenue dedicated to anti-poverty programs....Archbishop of Canterbury Rowan Williams, in his response to the occupation of St. Paul's Cathedral in London, endorsed the Vatican proposals. Williams observed that "people are frustrated beyond measure at what they see as the disastrous effects of global capitalism," and urged a full debate on "a Financial Transaction Tax

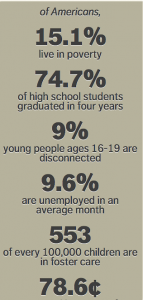

Perhaps the most important finding from the report is that we have both the experience and the policy tools necessary to cut poverty in half.

Between 1964 and 1973, under both Democratic and Republican administrations, the U.S. poverty rate fell by nearly half (43 percent) as a strong economy and effective public policy initiatives expanded the middle class.

Similarly, between 1993 and 2000, shared economic growth combined with policy interventions such as an enhanced earned income tax credit and minimum wage increase worked together to cut child poverty from 23 percent to 16 percent.

We can't do this alone.

Occupy America: A new great awakening. Election-year goals of Christian group questioned. Would you pledge $20.14 to end the war in Afghanistan? Religion And Immigration: We Have Not Yet Begun To Love.