To most of us in North America, the Third World debt crisis is one of those distant and impenetrably obscure issues encountered only occasionally in those brief and confusing reports on the back pages of the newspaper. We just know we've heard somewhere that it is supposed to be a serious problem for some reason.

But for most of the world's people, the debt issue is very real and very simple, as real and simple as a loaf of bread or a bowl of rice. If their governments pay the debt under current arrangements, they may not eat.

As of 1984, Third World countries owed a total of $895 billion to Western banks and governments. Simply maintaining annual interest payments has become an impossible burden for many countries. For instance, if the government of Peru paid at the rate currently demanded, interest on the debt would consume 60 percent of the export earnings on which the country's economy depends.

Often the only source of relief open to the debtor countries is assistance from the International Monetary Fund (IMF). But votes on IMF loan policy are weighted to reflect financial contribution to the fund. Consequently, Great Britain has more votes than all of black Africa, and the United States can out-vote all of black Africa and Latin America combined. So, not surprisingly, IMF proposals for Third World economies tend to bear the stamp of Reagan-Thatcherism.

IMF loan assistance is routinely made conditional on the acceptance of draconian austerity measures, including cuts in wages, social services, and food subsidies, and the adoption of "free market" tax and trade policies. Many countries have found the IMF cure to be worse than the ailment it is supposed to treat. For millions of poor and working-class people throughout Latin America, Asia, and Africa, international debt has become the foremost issue affecting both their immediate survival and their national sovereignty.

WHILE THE CURRENT level of Third World debt has specific causes related to the vagaries of the international capitalist economy in the last decade, its roots are firmly embedded in the centuries-old legacy of colonialism. In the colonizing process, lands and people that were once self-sufficient producers of foodstuffs became instead sources of cheap labor, raw materials, and luxury goods for the imperial powers and, eventually, captive markets for the "mother country's" excess manufacturing capacity.

Despite the trend toward political decolonization, the international economic order established after World War II still reflected the old patterns of dominance and dependence. Third World countries that resisted being tied into a structure dominated by Western interests and capitalist development models got a swift and brutal lesson in the limits of their newfound independence as our CIA became practiced in the politics of assassination and coup d'etat.

Because their export-oriented economies are dependent on trade with the nations of the North, especially the United States, most Third World countries are disproportionately affected by economic changes in this country. When the U.S. economy sneezes, the Third World catches pneumonia. The current debt crisis is in large part the result of that phenomenon.

Most of the loans now falling due were made by private transnational banks in the mid- and late 1970s. At that time, due to the Organization of Petroleum Exporting Countries (OPEC) oil boom, Western banks were flooded with petro-dollars in search of investment opportunities. Loans to governments are generally considered one of the safest investment risks, so the big banks became heavily involved in loans to Third World countries financing various--and often ill-conceived--development projects.

But within a few,years, U.S. interest rates, including those on loans owed by the Third World, skyrocketed. At the same time, the U.S. economy went into a recession that drove down the prices for many raw materials imported from Third World countries. Then the bottom fell out of the oil boom, leaving oil-producing nations like Mexico and Nigeria badly overextended and deeply in debt.

Many Third World countries spent their Western bank loans on the development of a local manufacturing base. The plan was to sell finished products to the U.S. market at cut-rate prices made possible by cheap labor and few health and safety regulations. But the current fashion in this country of excluding foreign products in order to protect U.S. jobs is leaving the Third World countries that invested heavily in industrialization holding the bag.

This convergence of historical factors added up to economic disaster for much of the Third World. And despite the U.S. economic recovery, the disaster in the South continues to deepen because outlandish U.S. deficits are keeping interest rates high, the dollar overvalued, and exports to the U.S. underpriced.

It should also be noted that much of the money loaned to Third World governments went for the purchase of extravagant military equipment from the United States and Western Europe. Another large portion was spirited away to Western banks and investments by corrupt local elites. And the portion that did go into economic development was spent on projects mostly beneficial to those same elites. But now that the note is due it is not the generals and land barons of Argentina or Brazil who are paying the price, but the workers, the peasants, and the unemployed.

IN MANY COUNTRIES, especially in Latin America, the ordinary people are increasingly refusing to accept such sacrifices on behalf of mega-banks like Citicorp and Chase Manhattan. The churches, labor unions, and other popular forces are insisting that the needs of the people must come before the profit of the banks. Military dictatorships, like the one in Chile, can deal with such discontent at gunpoint. But elected leaders in Argentina, Peru, Brazil, and Mexico are to some extent accountable to public opinion and thus increasingly unable to accede to the demands of foreign banks and the IMF. The president of Peru, Alan Garcia, has already announced that his country will not deal with the IMF and will not allow debt payments to exceed 10 percent of Peru's export earnings. As unrest mounts other leaders are likely to follow Garcia's example.

Meanwhile, a number of sane and reasonable proposals are emerging, in the Third World and the United States, to deal justly with the long-term problems the debt crisis presents. Many Third World leaders have rightly pointed out that the debt must be viewed in the larger context of North-South relations. They suggest that if one places a dollar figure on the amount extracted from the Third World through low wages and unfair pricing and trade policies, it is in fact the North that is in debt to the South.

Last October in Havana, Cuban leader Fidel Castro convened an emergency conference on the debt that was attended by politicians, business people, grassroots leaders, unionists, and church people from all of Latin America and the Caribbean. All of the assembled representatives agreed that the debt cannot and should not be paid. Castro himself called on Latin American governments to unilaterally cancel the debt.

Since the Havana conference, the United States has again declared the problem solved, this time by the "Baker Plan," named for U.S. Secretary of the Treasury James Baker. But the Baker Plan is really a new disguise for the old program of brutal austerity. The only change is that the World Bank is substituted for the IMF and, in a typically Reaganaut flourish, austerity is renamed "free market development." The people of the affected countries are unlikely to surrender before such a public relations non-solution.

Perhaps because the debt issue seems so abstract and complex, pressure from North American Christians for a more just U.S. policy has been slow in coming. But in the last year that has begun to change as our friends to the South have taught us to see the debt as, essentially, a religious issue. Frei Betto of the Brazilian Catholic Church put it well in a statement at the Havana conference which said in part:

I believe there are international problems about which one cannot ask the Bible to give a direct and immediate explanation ....But in relation to the theme we are dealing with here, the Word of God is quite clear. The Old Testament, as well as the New, speaks clearly of the injustice of debts that cause hunger and dependency and deprive people of the essentials of life. Long before Fidel proposed to cancel the debt the Bible already proposed a solution in the form of the "Jubilee Year." It was the custom among the ancient Hebrews that each 7 years all the debts that had caused any form of injustice were annulled.

So be it.

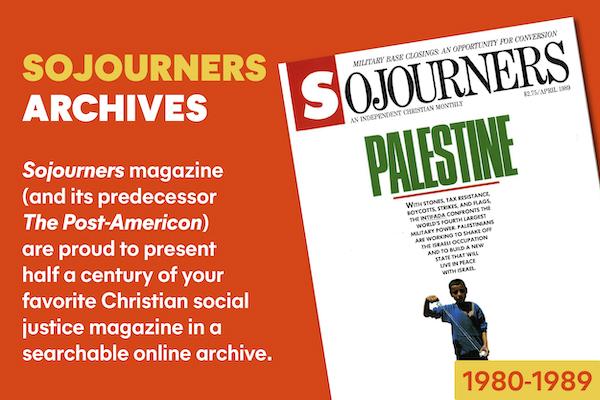

Danny Duncan Collum was an on the editorial staff of Sojourners magazine when this article appeared.

Got something to say about what you're reading? We value your feedback!