A year ago Sen. John McCain, an ardent supporter of the war in Iraq, took the Senate floor and chastised his fellow senators. "Throughout our history," McCain thundered, "war has been a time of sacrifice.... But about the only sacrifice taking place is that by the brave men and women fighting to defend and protect the liberties we hold so dear, and that of their families." McCain said he felt sickened by the tax cuts and pork barrel projects that Congress was passing. "This is a far cry from sacrifice."

Charlie Richardson, co-founder of Military Families Speak Out, is opposed to the war and advocates bringing home the troops. "Its disgusting that they are asking families like mine to make enormous sacrifices while they give tax cuts to billionaires," said Richardson. "Were having bake sales to buy Kevlar bulletproof vests to keep our kids alive in a war that never should have begun. Whatever happened to shared sacrifice?"

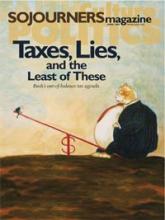

People on opposite sides of the Iraq war are shocked by the stunning inequality of sacrifice during this military engagement. Never in the history of U.S. warfare has Congress pushed tax cuts, let alone permanent tax cuts for the very wealthy. Historically, the opposite has been true: Wealth has been "conscripted," in the form of progressive income and estate taxes, to at least symbolize that everyone is contributing in some way.

THE U.S. HISTORY of progressive taxation is wound together with mobilizations for war. The first federal tax on wealth was levied in 1797, as our country was faced with the escalating costs of responding to French attacks on American shipping.

Read the Full Article