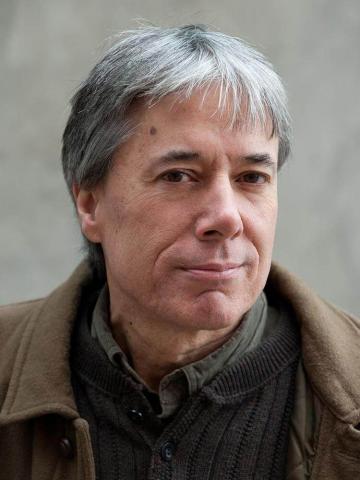

Chuck Collins is author of The Wealth Hoarders: How Billionaires Pay Millions to Hide Trillions. He is director of the Program on Inequality and the Common Good at the Institute for Policy Studies, where he co-edits Inequality.org.

Posts By This Author

How To Hide Wealth

The United States didn’t become a tax haven overnight.

TWO YEARS OF living through a pandemic has given us deeper insight into how extreme inequalities of income and wealth matter—and in some cases dictate who lives and who dies.

The pandemic economy supercharged existing inequalities, worsening the economic circumstances of the already precarious while further concentrating wealth and power in the hands of the already wealthy. In the first 21 months of the pandemic, roughly 700 U.S. billionaires saw their combined wealth increase by $2.2 trillion, even as millions lost their lives and livelihoods. A few hundred U.S. billionaires now have a combined wealth of $5.2 trillion, while the bottom half of all U.S. households—165 million people—have a combined $3.4 trillion.

It’s easy to see these inequality trends as invisible or remote forces without agency, or as failures of government policymakers to write the rules of the economy to ensure greater shared prosperity. However, there are private actors who function as “agents of inequality” whose daily work inflames existing divisions. These include what social scientists call the “wealth defense industry”—the veritable professional army of accountants, tax lawyers, wealth managers, and family office staffers that facilitates the hiding and sequestering of wealth.

These enablers serve the ultrawealthy—those with wealth upward of $30 million—and are paid millions to hide trillions. They labor to ensure that there is a two-tier tax system, with one set of rules for their ultrawealthy clients and another set of rules for everyone else. They also facilitate the creation of inherited wealth dynasties and monopoly power, directly exacerbating the existing racial wealth divide and entrenching concentrations of wealth and power.

The role of these enablers is in plain sight as nations around the world try to recover from the pandemic and find revenue to pay for it.

Who Is Buying My Neighborhood?

Anonymous corporations own more and more of our cities.

INVISIBLE FORCES ARE disrupting housing markets in most metropolitan areas, fueling the most acute housing crisis in a generation. As pandemic protections are lifted, many communities are anticipating waves of evictions and foreclosures. By one estimate, the U.S. has a shortage of more than 5.5 million units of housing.

Among these invisible forces is an explosion in short-term rentals, a shift to corporate ownership of rental housing, and a plague of global billionaires looking to park money in U.S. real estate markets. Put this on top of inequality-fueled gentrification and many cities have a full-blown affordability and supply crisis.

In some communities, thousands of apartments and homes are being snatched up by anonymous corporations. Now a growing number of community leaders are pressing to know: Who is buying our cities?

Wealth and the Common Good

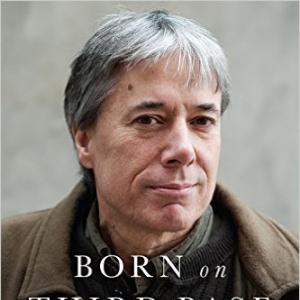

Born on Third Base: A One Percenter Makes the Case for Tackling Inequality, Bringing Wealth Home, and Committing to the Common Good. Chelsea Green.

WRITER AND ACTIVIST Chuck Collins, the great-grandson of meatpacker Oscar Mayer, gave up his inheritance when he was 26 and has spent the subsequent decades working to address economic inequality and environmental issues. Via email with Sojourners senior associate editor Julie Polter, he discussed his newest book, Born on Third Base: A One Percenter Makes the Case for Tackling Inequality, Bringing Wealth Home, and Committing to the Common Good (Chelsea Green)—and why organizing and building community across economic lines is good for everyone.

Sojourners: What is your main message in this book?

Chuck Collins: I want to invite wealthy and affluent people to “come home”—to return from wandering in the desert of wealth and privilege, the disconnection from community and place. It means putting a personal stake in reversing the deepening ruts of extreme wealth inequality and the ecological crisis. If we read the signs of the times, we understand this is both in our selfish interest as well as strengthening the common good. These inequalities and ecological challenges are undermining the quality of life for everyone, including wealthy people. There is no wealth on a degraded planet.

By reconnecting with people and places, we come out of exile. Racial and economic advantage is a “disconnection drug”—distancing us from both the suffering and the joy of being a human.

Many of the ultra-wealthy are “placeless” and “stateless”—literally holding multiple passports with money globalized in offshore financial centers around the world. So “coming home” means bringing the wealth home too—taking it out of the offshore tax havens, out of the global financial casino (“going off the Wall Street grid,” as one of the people I interview in Born on Third Base says), and out of the fossil fuel industry.

Why A Movement To Disinvest from Fossil Fuels?

If Quaker antislavery activist John Woolman were alive today, he would probably be doing everything in his power to resist the fossil fuel industries destabilizing our climate.

Woolman, who in the mid-1700s refused to cooperate with any aspect of the slave trade, would probably divest any ownership interest he had in big oil, gas, and coal companies. To profit financially from corporations that are destroying the planet would be unconscionable.

The divestment movement received a tremendous boost the day after 400,000 people took to the streets of New York City for the People’s Climate March. In advance of the United Nations Climate Summit on Sept. 22, the Rockefeller Brothers Fund — an $860 million foundation built on the oil fortune of John D. Rockefeller — announced its commitment to divest its holdings of fossil fuels.

This was the latest wave in a series of Divest-Invest announcements including the launch of Divest-Invest Individual, which facilitates a meaningful role for individuals in the divestment and reinvestment movements. More than 700 inaugural investors – with investments totaling $2.6 billion – announced their intention to divest from fossil fuel industries and reinvest in clean, renewable energy. Hundreds of individuals have since taken the pledge to stop new investments in fossil fuels and divest from the top 200 carbon-holding companies within five years.

“The destruction of the earth’s environment is the human rights challenge of our time,” said South African Archbishop Desmond Tutu in a video-taped message to the UN Climate Summit. He called on world leaders to freeze further exploration for new fossil fuel sources. “Divest from fossil fuels and invest in a clean energy future. Move your money out of the problem and into solutions.”

A Minimum of Justice

The movement for a fair minimum wage is bubbling up all over.

ON NOV. 5, 2013, the people of SeaTac, Wash., enacted the highest minimum wage in the country, $15 an hour, more than double the federal minimum wage of $7.25 an hour.

On Black Friday, the biggest shopping day of the year, Wal-Mart workers at more than 1,500 store locations conducted protests and informational pickets. Fast-food workers in more than 100 cities protested in front of McDonalds, KFC, and Taco Bell stores, calling for wage increases.

Across the U.S., a grassroots movement is blossoming to address the extreme inequality of wealth and wages. Led by low-wage workers and bolstered by faith community leaders, this movement is shining a spotlight on the glaring disparity of wages, wealth, and opportunity.

The wealthiest 1 percent of households, those with annual incomes over $555,000, now receives more than 21 percent of all income. Meanwhile, millions of low-wage workers subsist on the federal minimum wage, which is $15,080 a year for a full-time worker. As a result, many low-wage workers depend on charity and public subsidies such as food stamps and Medicaid to survive.

If the minimum wage had kept up with inflation since 1968, it would now be $10.74, enough to boost a family of three over the federal poverty line, according to the Economic Policy Institute. If the minimum wage had increased at the pace of worker productivity, it would be $18.72 an hour today.

Missing Servant Leaders on Corporate Tax Responsibility

We're sorely missing the servant leadership of America's CEOs on matters of corporate taxation.

As Congress contemplates trillions in budget cuts that will worsen poverty and undermine the quality of life in America, consider these findings from a new report that I co-authored, "Massive CEO Rewards for Tax Dodging," by the Institute for Policy Studies.

Last year, the compensation of 25 CEOs at major profitable U.S. companies was larger than the entire amount their company paid in U.S. corporate taxes.

These 25 include the CEOs of Verizon, Boeing, Honeywell, General Electric, International Paper, Prudential, eBay, Bank of New York Mellon, Ford, Motorola, Qwest Communications, Dow Chemical, and Stanley Black and Decker.

Poverty, Treasure Islands, and Global Tax Dodgers

As Christians concerned about poverty, it is time to turn our full attention to the injustices of an "offshore tax system" that enables corporations and the wealthy to dodge taxes and impoverish countries around the world.

As members of Congress in the United States debate deep and painful budget cuts, people of faith should raise our voices against an unfair system that enables profitable U.S. corporations to dodge taxes, depleting an estimated $100 billion from the U.S. Treasury each year. Instead of cutting $1 trillion over the next decade from programs that assist the poor and ensure greater opportunity, we should eliminate these destructive tax gimmicks.

Recent reports show that aggressive tax dodgers such as General Electric, Boeing, and Pfizer, avoid billions in taxes a year. They use accounting gymnastics to pretend they are making profits in offshore subsidiaries incorporated in low- or no-tax countries like the Cayman Islands, thereby reducing their tax obligations in the United States. This system is unfair to domestic businesses that have to compete on an un-level playing field.

What Would Jesus Tax?

In the face of state and federal budget cuts, many of us have been fasting and contemplating the question: "What would Jesus cut?" In light of tax day, however, we might equally contemplate: "What would Jesus tax?"

After all, a great deal of our budgetary stress is the result of declining revenue, thanks to the economic downturn and decades of tax cuts.

A new report that I co-authored, "Unnecessary Austerity," argues that before we make draconian budget cuts at the federal and state level, we should reverse huge tax cuts for the wealthy and tax dodging corporations.

The Jesus I know would be concerned about the extreme inequalities of wealth and power that have emerged in our communities. He would rail against principalities and powers that rig the tax rules so the privileged pay less.

He would lament the destruction of God's creation through excessive consumption and pollution. And, he would be alarmed about financial and commodity speculation driving up the cost of food and worsening hunger. (In today's world of high finance, someone would be hedging investments on how quickly Jesus could multiply loaves and fishes.)

Taxes and the Common Good

It's time to reform our tax system-- to quit rewarding obscene wealth, Wall Street gambling, and corporate polluters.

A Grassroots Call to Tackle Corporate Tax Dodging

Across the United States, there is a new movement emerging to dramatize the immorality of corporate tax dodging in the face of drastic budget cuts.

Moral Measure of a Tax Plan

In 2010, the moral measure of tax policy choice is: Does it further concentrate wealth and power in the hands of a few?

Shirley Sherrod: A Moral Giant

A Reading for April 15: The Parable of the Taxpayer

Five Benefits of Common Security Clubs' Economic Solidarity

Tax Day Wish: Prophetic Voices on Taxes

We're in This Together

As our economy continues to decline, "common security clubs" are one way people can support each other and take action for a more just future.